🗣 SL提问: Financialregulation

✍️ Ai批改: Financial regulation refers to the rules, laws, and guidelines that govern the conduct of financial institutions and markets、The primary goal of financial regulation is to promote stability, transparency, and fairness in the financial system, while also protecting consumers and investors、Here are some key aspects of financial regulation:

Objectives of Financial Regulation:

1、Stability: To maintain stability in the financial system by preventing excessive risk-taking and ensuring that financial institutions have sufficient capital and liquidity to withstand shocks.

2、Consumer Protection: To protect consumers from unfair or deceptive practices by financial institutions, such as mis-selling of financial products or unfair lending terms.

3、Market Integrity: To ensure that financial markets operate fairly and transparently, with accurate and timely disclosure of information.

4、Investor Protection: To protect investors from fraudulent activities, such as insider trading or market manipulation.

Types of Financial Regulation:

1、Prudential Regulation: Focuses on the safety and soundness of financial institutions, such as banks and insurance companies.

2、Conduct Regulation: Focuses on the behavior of financial institutions and their interactions with customers and markets.

3、Market Regulation: Focuses on the operation of financial markets, including trading, listing, and disclosure requirements.

Key Regulatory Bodies:

1、Central Banks: Such as the Federal Reserve in the United States or the European Central Bank in the European Union, which regulate monetary policy and banking stability.

2、Securities Regulators: Such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom, which regulate securities markets and trading.

3、Financial Conduct Authorities: Such as the FCA in the United Kingdom or the Consumer Financial Protection Bureau (CFPB) in the United States, which regulate consumer protection and conduct of financial institutions.

Examples of Financial Regulations:

1、Dodd-Frank Act (2010): A comprehensive financial reform law in the United States aimed at improving financial stability and consumer protection.

2、Basel Accords: International agreements that set common standards for bank capital requirements and risk management.

3、MiFID II (2018): A European Union regulation that aims to improve transparency and investor protection in financial markets.

Challenges and Current Issues:

1、Regulatory Complexity: The increasing complexity of financial markets and products can make regulation more challenging.

2、Regulatory Arbitrage: Financial institutions may seek to exploit loopholes or differences in regulatory regimes across jurisdictions.

3、Digitalization: The growth of fintech and digital currencies raises new regulatory challenges, such as ensuring consumer protection and preventing money laundering.

Best Practices in Financial Regulation:

1、Risk-Based Approach: Regulators should focus on high-risk areas and institutions.

2、Proportionality: Regulations should be proportionate to the risks posed and not overly burdensome.

3、International Cooperation: Regulators should collaborate across borders to address global financial stability and regulatory challenges.

Effective financial regulation is crucial for maintaining stability, fairness, and transparency in financial markets, and for protecting consumers and investors、However, regulatory challenges and complexities continue to evolve, requiring ongoing adaptation and improvement of regulatory frameworks.

0

IP地址: 150.68.146.16

搜索次数: 251

提问时间: 2025-04-11 11:44:52

❓️ 热门提问:

外汇平台还在就是钱提不出来

代表五行金的饰品

各种黄金

mitata ai

4g黄金值多少钱

汇添富优质成长混合C

金棕色是什么颜色

详细介绍域名www.yu8.gz.cn的含义、价值与适合的行业。

ai分析项目代码

怎么辨别金矿

豌豆Ai站群搜索引擎系统

🤝 关于我们:

三乐Ai

作文批改

英语分析

在线翻译

拍照识图

Ai提问

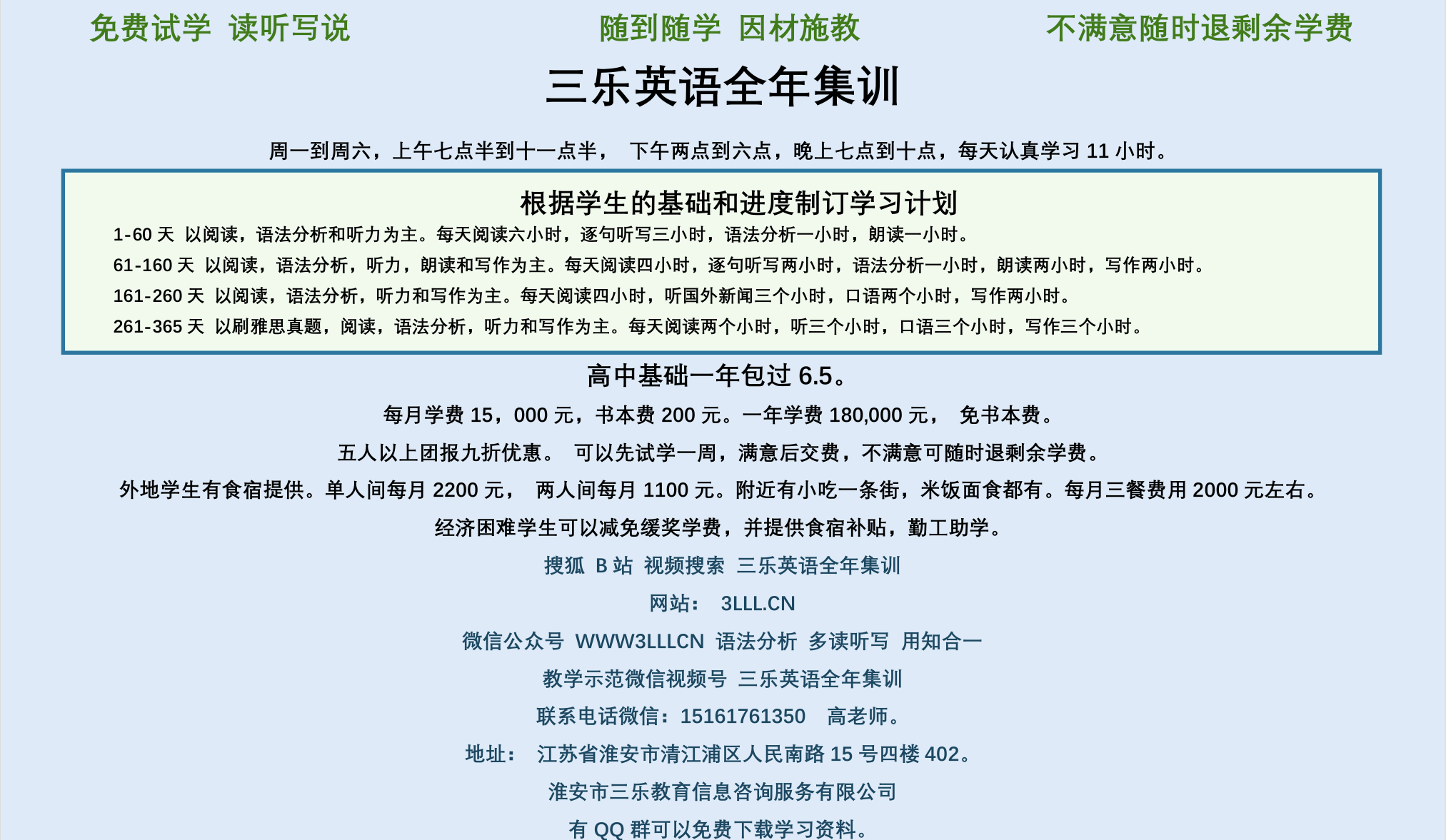

英语培训

本站流量

联系我们

📢 温馨提示:本站所有问答由Ai自动创作,内容仅供参考,若有误差请用“联系”里面信息通知我们人工修改或删除。

👉 技术支持:本站由豌豆Ai提供技术支持,使用的最新版:《豌豆Ai站群搜索引擎系统 V.25.05.20》搭建本站。